Professional Payroll Services

Benefits Compliance Administration

easy & risk free

Countick offers seamless professional payroll services for businesses of all sizes. From startups to established corporations, our expert support ensures hassle-free payroll processing. Streamline your payroll today!

Experience the freedom of integrated payroll services with Countick

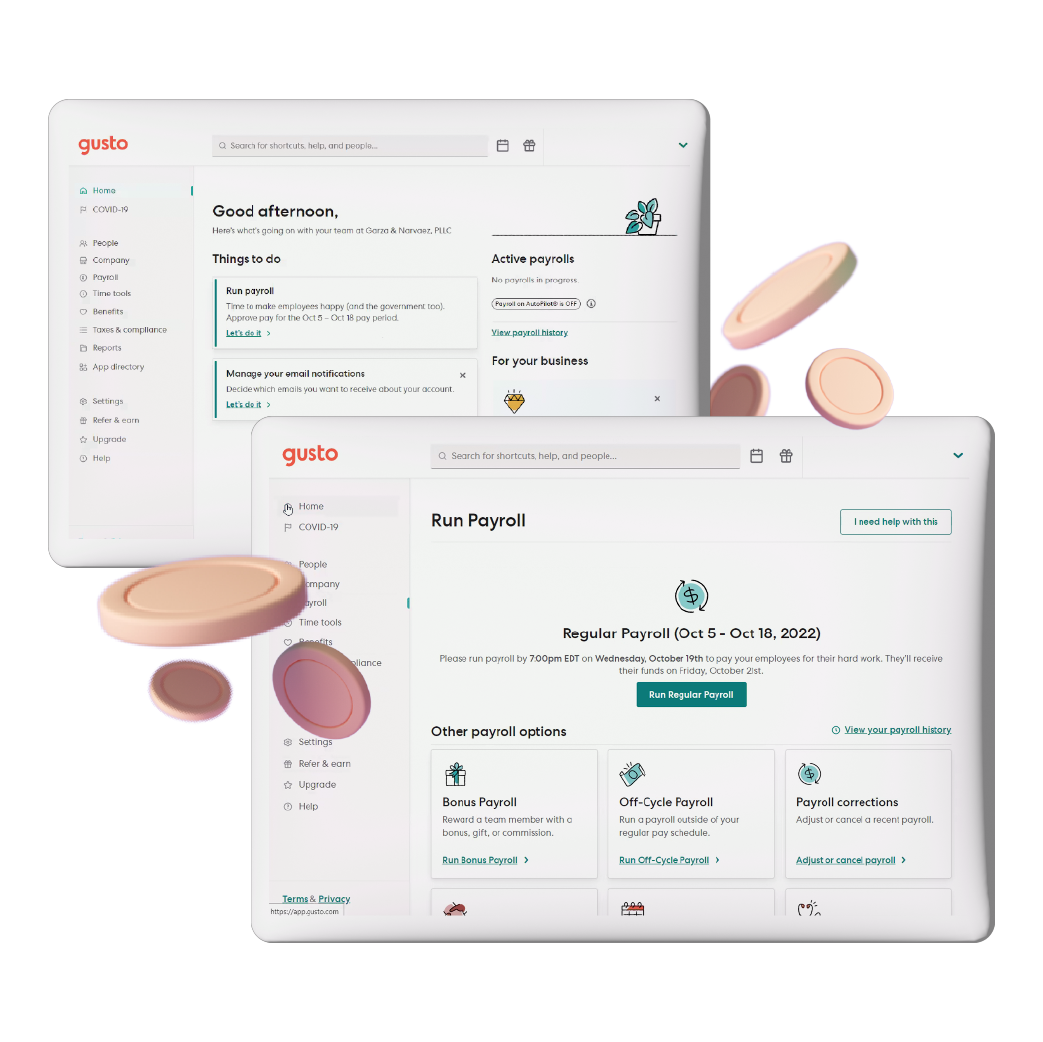

One price,

all the features

Direct deposit, online portal access for employees, year-end compliance and reporting with your Countick team backing it up.

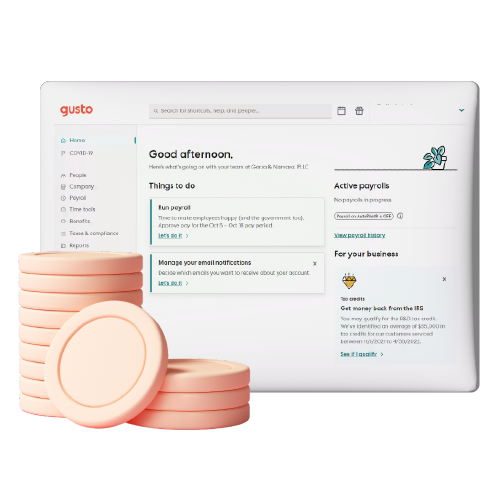

Plan for year-end

from day one

By automating your calculations and remittances right from the start, you’ll be better prepared for reconciling and reporting at the end of the year.

Quickly pay employees

and contractors

We offer automated payroll for employees and contractors, tax filing assistance, compliance support, and uncover hidden tax credits.

Payroll Solutions that won't break the bank

Pay your employees,

leave the details to us

Processing payroll can be a demanding job. With your business taking off, this is the last thing you want to worry about. Countick takes that stress away and manages payroll, direct deposit, tax, and more. We promise to keep transparent communication when taking care of your business needs.

We’re happy to answer questions and provide support whenever you need it.

Your Critical business information, secured

Countick ensures confidentiality when providing all payroll services. All paperwork processes are in compliance with the necessary laws and practices. We’re serious about your privacy. We secure all information sent to our clients over a secure network.

A Simple Way to Pay Your Employees

never worry about the basics with our payroll services

Payroll, Benefits and compliance

Accuracy & peace of mind

honest pricing & no hidden fees

FAQ's

You can find detailed pricing on our pricing page. However, our basic payroll package starts from $300.

Utilizing a payroll service ensures accurate payroll processing, compliance with tax laws, data security, and expert support. It reduces administrative burden, allowing focus on core business tasks and provides peace of mind.

Yes, payroll service fees are typically tax deductible as business expenses. However, it's recommended to consult with a tax professional or accountant to ensure compliance with tax regulations and eligibility for deductions.

We handle the filing of W-2s and 1099s on your behalf. Both employees and contractors receive electronic copies of their forms. We'll file comprehensive W-2s for the entire year, gathering wage data during setup for accurate reporting according to your selected package.

Each Countick plan offers unlimited payroll runs, with no additional charges for tasks such as off-cycle payrolls.

Partnered with industry leading platforms.