Complete Suite Accounting services for small businesses

At Coutick, we're your trusted partner in streamlining accounting solutions. We simplify your financial processes with tailored expertise, letting you focus on business growth. Discover transparent pricing and honest service, ensuring you have the support you need to thrive in today's dynamic marketplace.

How do our accounting services work?

Explore the ease of accounting solutions with Countick. We seamlessly unite with your team, managing all accounting needs from fundamental to complex tasks. With our proficiency in accounting services for startups and growing businesses, we optimize operations, enabling your firm to prioritize expansion. Experience unparalleled efficiency with each transaction.

Seamless Team Extension

Countick team integrates with your team, providing efficient outsourced accounting solutions covering basic to complex tasks.

Beyond Cost Savings

Virtual accounting service isn't just about cost savings. It unlocks value, addresses talent shortages, and expands service offerings, scaling your firm.

Simplified Accounting with Us

Partnering with Countick makes your business the go-to destination for accounting needs, providing expertise and resources to exceed expectations.

Partnered with industry leading platforms.

One-Stop Accounting Solutions for Businesses. Scale, Adapt, Succeed!

Maximize your business’s capabilities with Countick’s extensive outsourced accounting services. Our customized solutions transcend basic delegation, empowering you to strategically expand your firm and support it against future hurdles. Through personalized service options and a commitment to resilience, we pave the path for sustained growth and unparalleled success. Count on our online accounting services as your trusted partner in financial excellence, guiding you toward achieving your business objectives every step of the way.

Transform Your Finances with Our Strategic Planning & Expert Execution!

Our Accounting firm uses platforms such as Xero, NetSuite, QuickBooks, and Sage to help you create financial strategies, forecast financial standings, prepare budgets, manage cash flow, and identify compliance shifts. Consequently, we function as a comprehensive accounting service provider for our clientele and are recognized as a specialist in the industry. Through Countick’s external accounting services for small enterprises, you aren’t merely delegating tasks; you’re implementing practical measures to escalate your company’s expansion.

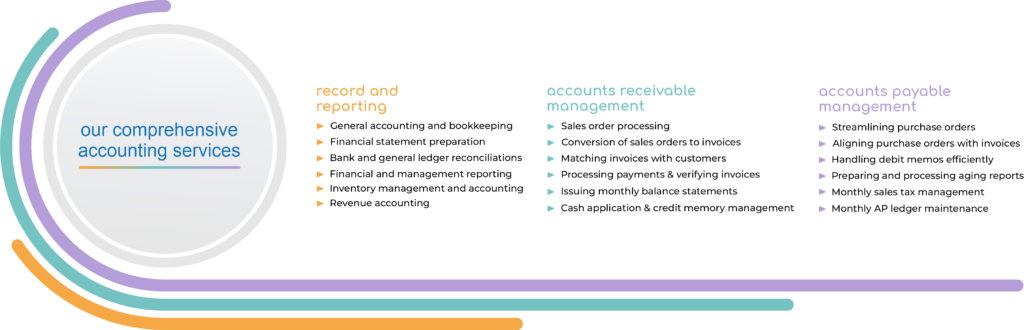

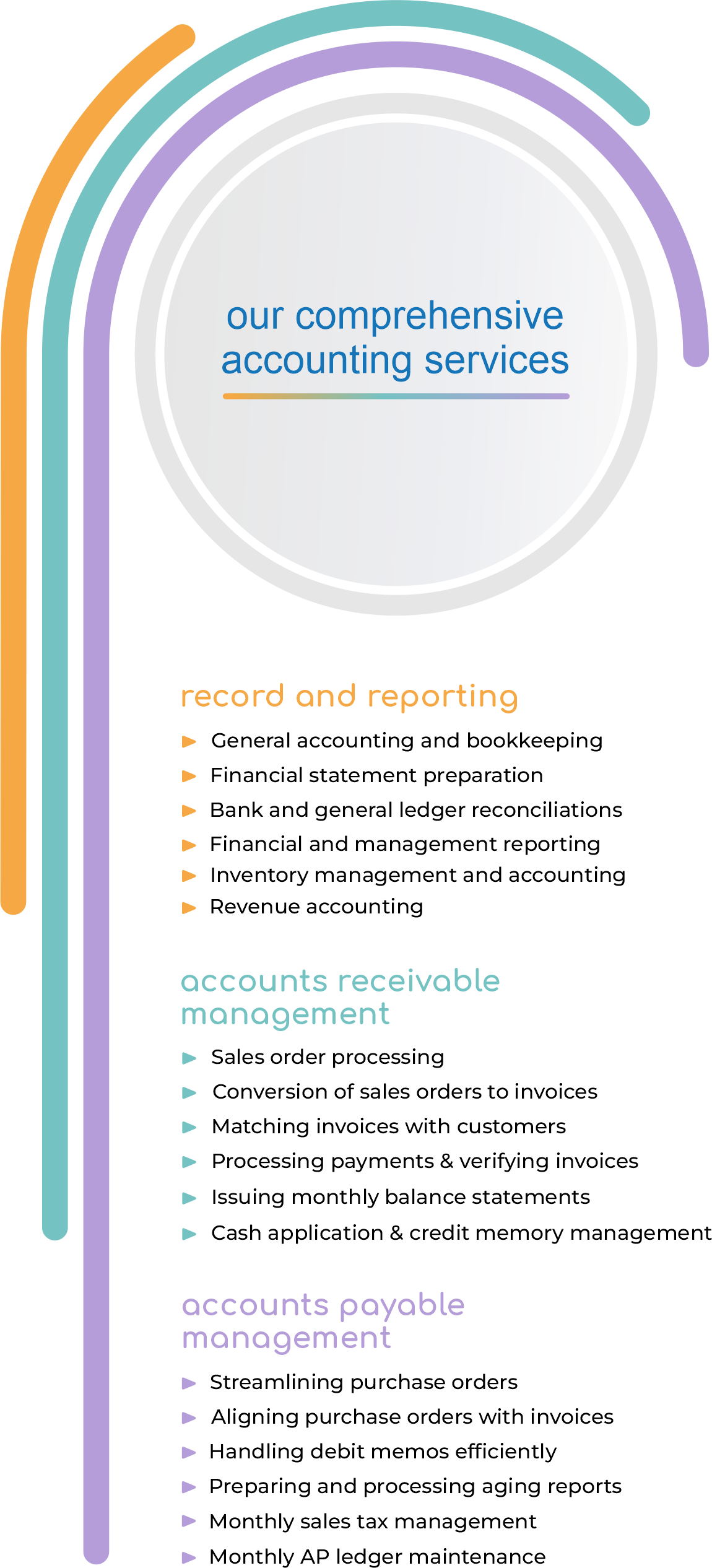

Our Comprehensive Accounting Services

Accounts Payable Management

- Streamlining Purchase Orders

- Aligning Purchase Orders with Invoices

- Handling Debit Memos Efficiently

- Preparing and Processing Aging Reports

- Monthly Sales Tax Management

- Monthly AP Ledger Maintenance

Accounts Receivable Management

- Sales Order Processing

- Conversion of Sales Orders to Invoices

- Matching Invoices with Customers

- Processing Payments & Verifying Invoices

- Issuing Monthly Balance Statements

- Cash Application & Credit Memo Management

Recording and Reporting

- General Accounting and Bookkeeping

- Financial Statement Preparation

- Bank and General Ledger Reconciliations

- Financial and Management Reporting

- Inventory Management and Accounting

- Revenue Accounting and

Transparent Pricing Tailored to Your Needs!

Discover our straightforward pricing model based on your employee count and pay frequency. No hidden fees, just honest rates. Click to view our pricing and find the perfect plan for your business today!

FAQ's

Research the accounting firm in the USA, check their expertise and services, evaluate pricing, read client reviews, and consider referrals to choose the best accounting firm in the USA.

Accounting for small businesses ensures financial health, tracks expenses, aids in tax compliance, facilitates decision-making, secures funding, and enhances credibility.

Accounting is crucial for startups to track finances, manage cash flow, monitor expenses, prepare for taxes, attract investors, and make informed strategic decisions for business growth.

Accounting aids small businesses by tracking finances, managing cash flow, monitoring expenses, preparing tax filings, providing financial insights, and facilitating informed decision-making for sustainable growth.